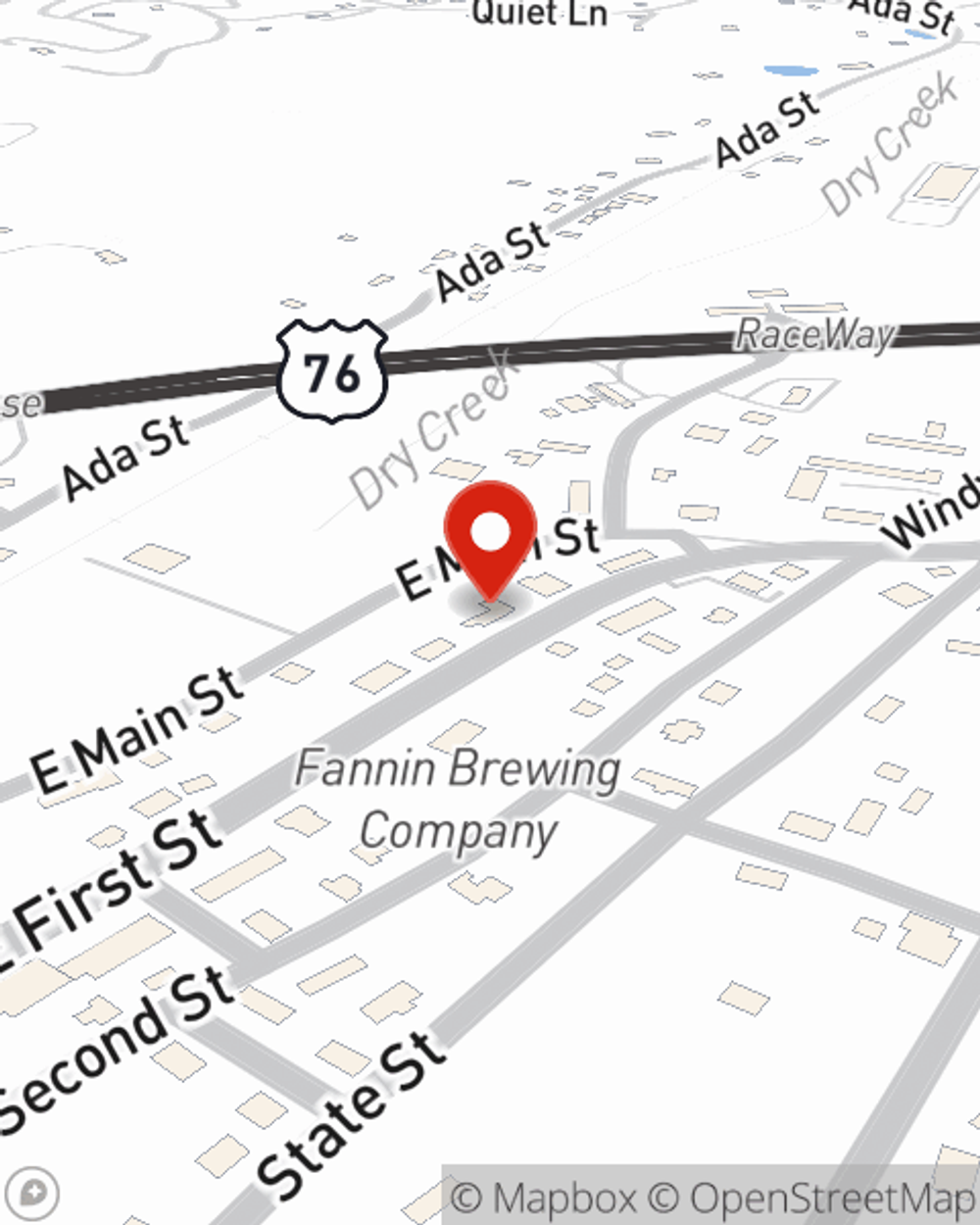

Business Insurance in and around Blue Ridge

Searching for insurance for your business? Look no further than State Farm agent Rebecca Mathis!

No funny business here

Coverage With State Farm Can Help Your Small Business.

Small business owners like you have a lot on your plate. From tech support to financial whiz, you do whatever is needed each day to make your business a success. Are you an electrician, a barber or a painter? Do you own a pottery shop, a bridal shop or a travel agency? Whatever you do, State Farm may have small business insurance to cover it.

Searching for insurance for your business? Look no further than State Farm agent Rebecca Mathis!

No funny business here

Protect Your Business With State Farm

When one is as driven about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for surety and fidelity bonds, business owners policies, commercial liability umbrella policies, and more.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Rebecca Mathis is here to help you explore your options. Get in touch today!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Rebecca Mathis

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.